Growth Management is the process in place to ensure that the company’s market value increases on a consistent basis.

The following key tenets will ensure growth on a long-term basis:

1. Identify the major sources of Stress or Failure

- Determine the real causes of the company’s financial problems and address them with a bold and practical action plan.

2. Increase Cash Reserves to meet long-term financial obligations

- Implement robust accounts receivable collection program to reduce overall financial stress

- Reduce progressively inventory to reduce holding costs

- Establish priority payment on accounts payable to conserve cash

- Consolidate all purchasing if possible to generate savings

3. Reduce Operating Costs as necessary

- Activate an emergency cost structure that will eliminate all non-survival expenses in case of business slow-downs. This structure will stay activated until the business is financially sound again.

SOLUTIONS

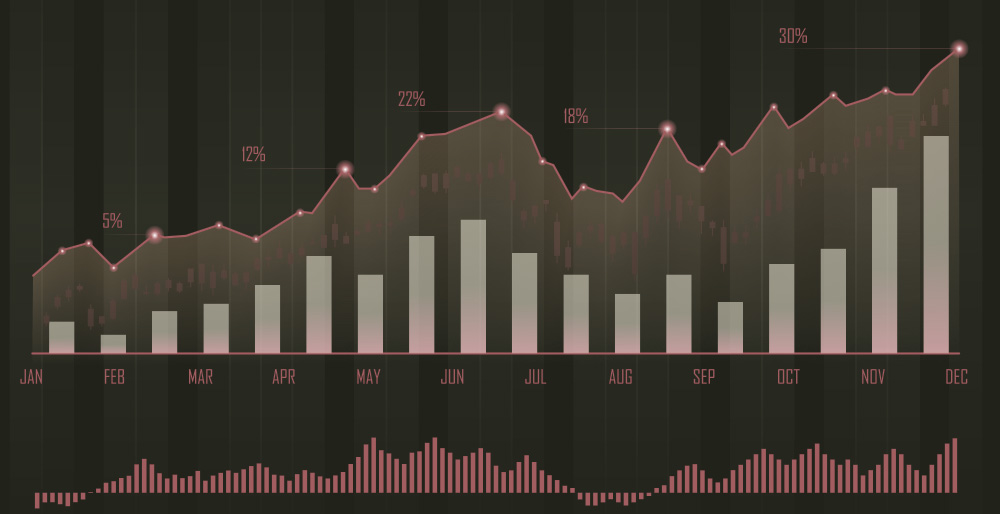

Analyze and manage the growth the company on a monthly or yearly basis and gather the following information:

- Net Profit Margin (Return On Investment)

- Operating Profit Margin (Return On Investment Before Interest and taxes)

- Gross Margin ( Return On Investment Before Variable and Fixed Costs)

- Break-even Amounts by period (The minimum amount required to remain operational)

- Retained Earnings (The progressive amount retained into the company’s balance sheet)

- Balance Sheet Overview (Equity, Assets, Liabilities)

- Debt/Asset Overview (Financial Stability)

- Efficiency Ratios (Key Financial Performance Indicators)

- Cash Flow Overview (Cash Financed, Cash Invested, Operating Cash, Net Cash Flow)

- Working Capital Overview (Current cash available after paying current liabilities)

RESULTS

- Greater assurance that the business will remain viable on a long-term basis

- Interest from investors because the business would demonstrate progressive growth

- Progressive growth of the company and greater marketability

Other articles

UNDERSTANDING FINANCIAL RATIOS

Ratios are the Key Performance Indicators (KPIs) of a company and are divided into four sections: 1. Liquidity Ratios 2. Profitability Ratios 3. Financial Leverage Ratios 4. Efficiency Ratios Liquidity Ratios Working Capital Definition: The amount of capital available...

DEVELOPING THE BEST FINANCIAL STRUCTURE

Get it sooner and you can invest it faster. The decision-making process is always easier if the top leadership is able to review swiftly the financial information of the company. For example, it should be unacceptable to wait weeks just to receive reports about the...

COMPENSATION ANALYSIS EXPLAINED

IMPORTANCE

The Compensation Analysis examines the financial burden and contribution of employees in an organization. Many decision makers tend to ignore the compensation analysis and it is to their detriment for long-term success.

PERFORMANCE MANAGEMENT EXPLAINED

IMPORTANCE

Performance Management measures the efficiency of the business and financial systems of a company. It also serves to enlighten possible areas of concern that may be detrimental to the organization’s smooth operation and financial profitability.

WHAT IS BUSINESS INTELLIGENCE (BI), AND HOW HELPFUL IS IT?

We live in a new Era We live in an era where speed and efficiency are the most desirable characteristics. The ability to obtain data, manipulate it, and develop actionable steps based on the information collected determines the secret to achieving these two factors....

FINANCIAL ANALYSIS EXPLAINED

IMPORTANCE

The financial analysis enables the decision-maker to review the financial information of the company and make the best decisions. It should be unacceptable to manage any operation or project without fully understanding your financial position.