Cost Benefit Analysis should be the driving force when speculating.

There are many different methods available to manage inventory. The most effective will always involve attention to detail, offer a precise accounting of the volume at any given point in time, and provide useful information to decision makers regarding reorder points. In other words, they will utilize not only present-day information, but look back at historical trends and projected future business volumes and prices in order to help in making purchase choices when the information is useful and relevant.

Cyclical Inventory Systems have proven to be the most efficient. This is especially true for the organizations offering indirect products. A cyclical inventory system is achievable if a solid management system is in place that emphasizes the usage of systematic formulas that would calculate the right amount of inventory to have on shelf on any given day. There are multitudes of software applications available to help calculate current and future inventory needs. However, the available technology alone is not sufficient for the implementation of successful cyclical inventory systems.

Insight:

The cyclical inventory system is difficult to maintain without a certain level of continuity and commitment. Many managers who choose to implement a cyclical system begin with the best of intentions. But then something unexpected happens, and a “temporary” deviation is deemed acceptable in “extenuating” circumstances. There are two problems with this exception, however. First, it detracts from the overall reliability of the cyclical system’s records, as these rely on a continuous flow of accurate information. Secondly, once the system’s integrity is breached, it becomes that much more difficult to return it to a prime operating condition.

For instance, let’s assume that a major supplier offered a one-time discount on all of its products. The less disciplined managers would jump with excitement and buy as much as they can. In their minds, these types of deals do not come often. So why not stock up when the opportunity arises? The logic in this scenario is that it makes perfect business sense to stockpile cheap inventories. There is the problem! Good managers, however, are able to maintain composure. They recognize instantly that the savings available through stocking up on the cheap products can easily be undone by elevated costs associated with handling, holding, and overall management of higher levels of inventory. Before you make the decision to buy a lot when the market is low, be sure to conduct a cost-benefit analysis as to all of the “unanticipated” or indirect costs that will result from your decision.

Example:

We will use the following scenario to elaborate further on the importance of a cyclical inventory system tied to a cost-benefit analysis.

Let’s assume the following about a Company’s inventory structure and the current “savings” associated with purchasing new inventory—it is by the way, $4,500:

| Total current used space in square feet | 10,000 |

| New inventory space requirement in square feet** | 3000 |

| *Savings achieved from buying new inventory | $4,500 |

| Handling cost of new inventory | $2,700 |

| Current Monthly Rent | $10,000 |

Debrief:

Let’s take a moment to examine this example in some more detail. Here are the main elements of the problem so far …

A. The Company is paying $10,000 per month to rent 10,000 square feet, which amounts to $1/sq.

B. The new inventory space requirement is 3000 square feet or $3,000.

C. With inventory, also come handling costs, which are usually the labor and packaging costs required to shelve properly the new inventory. In this example, it is $2700.

Let’s Solve it. Here we are holding everything else constant:

| Current Cost of Space per Square Feet | |

| Monthly Rent | $10,000 |

| Total Available Space in Square Feet | 10,000 |

| Current Monthly Price Per Square Feet | $1.00 |

| New Inventory Cost | |

| Space Requirement = 3000 * $1 | $3,000 |

| Handling cost of new inventory | $2,700 |

| True Cost of New Inventory | $5,700 |

| New inventory Cost Benefit Analysis | |

| New Inventory Savings from Discount | $4,500 |

| True cost of New inventory | $5,700 |

| Actual Benefit/Loss | ($1,200) |

Debrief:

The Company will actually lose $1,200 if it purchases the new inventory. Even if the Company broke-even because of the new purchase, it is still a bad decision. The savings must be large enough to justify the cost and effort associated with increase in new inventory. This simple example demonstrates the importance of always associating the purchase of new inventory with a cost-benefit analysis.

Other articles

DEVELOPING THE BEST FINANCIAL STRUCTURE

Get it sooner and you can invest it faster. The decision-making process is always easier if the top leadership is able to review swiftly the financial information of the company. For example, it should be unacceptable to wait weeks just to receive reports about the...

COMPENSATION ANALYSIS EXPLAINED

IMPORTANCE

The Compensation Analysis examines the financial burden and contribution of employees in an organization. Many decision makers tend to ignore the compensation analysis and it is to their detriment for long-term success.

PERFORMANCE MANAGEMENT EXPLAINED

IMPORTANCE

Performance Management measures the efficiency of the business and financial systems of a company. It also serves to enlighten possible areas of concern that may be detrimental to the organization’s smooth operation and financial profitability.

WHAT IS BUSINESS INTELLIGENCE (BI), AND HOW HELPFUL IS IT?

We live in a new Era We live in an era where speed and efficiency are the most desirable characteristics. The ability to obtain data, manipulate it, and develop actionable steps based on the information collected determines the secret to achieving these two factors....

GROWTH MANAGEMENT EXPLAINED

IMPORTANCE

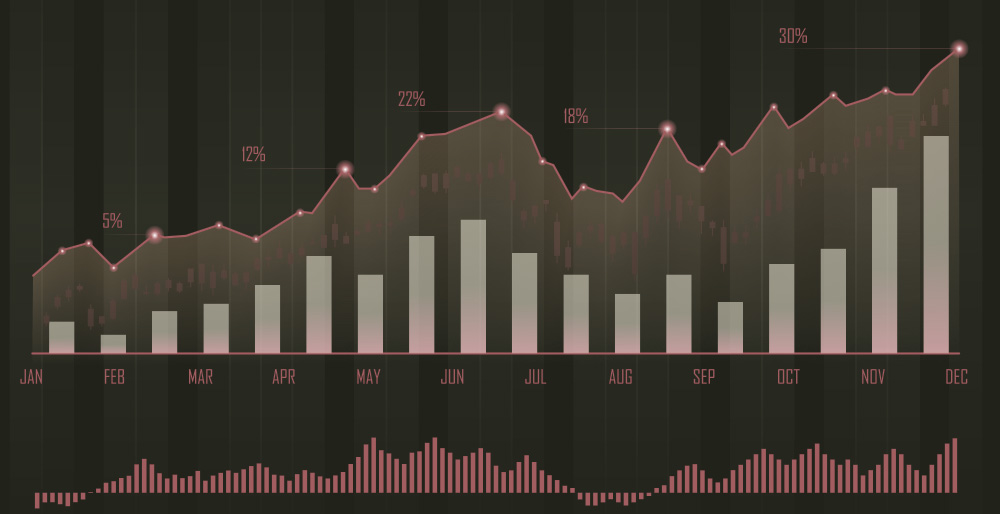

Growth Management is the process in place to ensure that the company’s market value increases on a consistent basis.

The following key tenets will ensure growth on a long-term basis:

FINANCIAL ANALYSIS EXPLAINED

IMPORTANCE

The financial analysis enables the decision-maker to review the financial information of the company and make the best decisions. It should be unacceptable to manage any operation or project without fully understanding your financial position.