IMPORTANCE

Performance Management measures the efficiency of the business and financial systems of a company. It also serves to enlighten possible areas of concern that may be detrimental to the organization’s smooth operation and financial profitability.

Without developing an efficient organizational structure, any business has little chance of being profitable long-term. Performance management helps to construct a business model that is positioned to increase consistently the execution and productivity levels. Determining your areas of weaknesses and strengths will help to forge a business model that has the potential of being sustainable on a long-term basis.

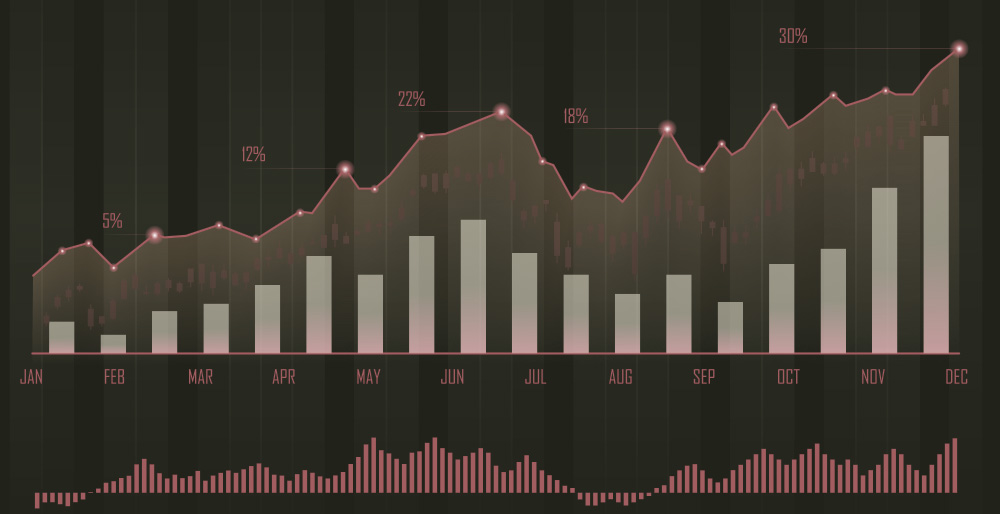

Performance Management is the foundation of business success. Essentially, if you cannot track it, you cannot control or manage it. Strong Performance Management systems analyze the following:

- Profit growth

- Cost allocation

- Product/Service Contribution to overall sales and profits

- Gross Margins

- Fixed and variable costs margins

- Financial goals and milestones

- Employees’ burden and contribution to the company

- Sales efficiency

- Over-spending and waste

SOLUTIONS

- Install Effective financial management systems to ease workflow

- Help you develop a specific financial plan to grow your business long-term and create wealth

- Help employees understand their unique contribution to the company

- Develop financial control systems to prevent lack of consistent productivity

- Develop a simple formula to generate consistent profits

- Develop a simple model to achieve expected financial milestones

RESULTS

- Less stress when making routine financial decisions

- More assurance that mechanisms exist to prevent waste, fraud and abuse

- Increased profitability since the entire operation will be optimized

- Greater chance to remain competitive on a long-term basis

Other articles

UNDERSTANDING FINANCIAL RATIOS

Ratios are the Key Performance Indicators (KPIs) of a company and are divided into four sections: 1. Liquidity Ratios 2. Profitability Ratios 3. Financial Leverage Ratios 4. Efficiency Ratios Liquidity Ratios Working Capital Definition: The amount of capital available...

DEVELOPING THE BEST FINANCIAL STRUCTURE

Get it sooner and you can invest it faster. The decision-making process is always easier if the top leadership is able to review swiftly the financial information of the company. For example, it should be unacceptable to wait weeks just to receive reports about the...

COMPENSATION ANALYSIS EXPLAINED

IMPORTANCE

The Compensation Analysis examines the financial burden and contribution of employees in an organization. Many decision makers tend to ignore the compensation analysis and it is to their detriment for long-term success.

WHAT IS BUSINESS INTELLIGENCE (BI), AND HOW HELPFUL IS IT?

We live in a new Era We live in an era where speed and efficiency are the most desirable characteristics. The ability to obtain data, manipulate it, and develop actionable steps based on the information collected determines the secret to achieving these two factors....

GROWTH MANAGEMENT EXPLAINED

IMPORTANCE

Growth Management is the process in place to ensure that the company’s market value increases on a consistent basis.

The following key tenets will ensure growth on a long-term basis:

FINANCIAL ANALYSIS EXPLAINED

IMPORTANCE

The financial analysis enables the decision-maker to review the financial information of the company and make the best decisions. It should be unacceptable to manage any operation or project without fully understanding your financial position.