FACTS:

- Most businesses do not possess the required tools and resources to evaluate properly their investments. Some of these investments include: a new branch office in another country, a new equipment, a construction project, a new product/service, etc.

- They don’t know what specific intelligence they need to decide whether to: Continue, Modify, or Reject a specific project

- They cannot develop objective assessments because they are too involved in it. It is referred to as: “Inside of the bubble factor”

- They don’t know if the proper systems are installed for accurate reporting of all financial transactions

These factors prevent the development of an accurate investment analysis process. Many companies have gone bankrupt simply because they made dangerous investment/debt decisions. They could have been avoided if they understood precisely the impacts of these new financial burdens.

SOLUTION

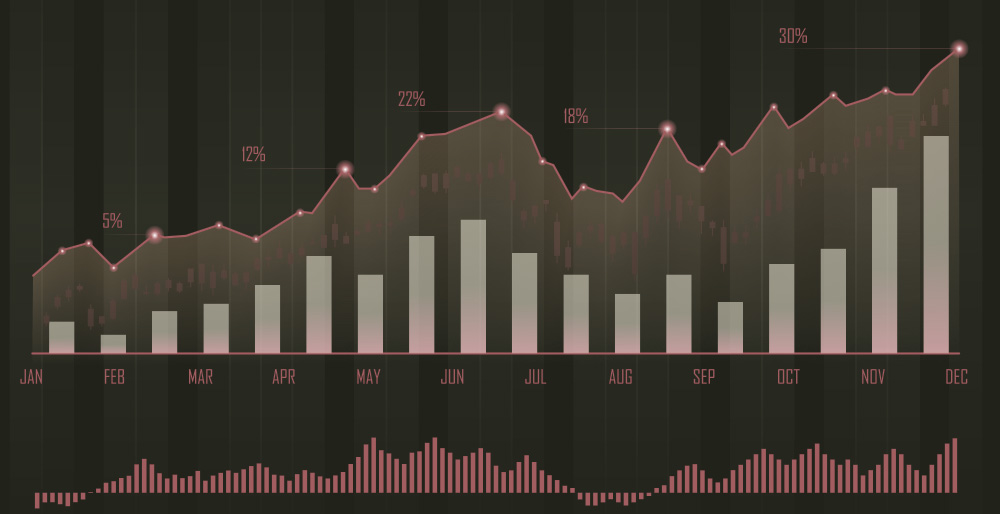

To smartly analyze your historic financial performance and predicts your future profit level and financial stability. Once you provide the expected investment amount, you will be able to know:

- How long it will take to pay it back if it is a debt

- How it will affect your profit and retained earnings if you must disburse a percentage to the investor

RESULTS

- Never make decisions that are not justified by verifiable intelligence

- Take on more debt than you can handle

- Take on investment that will not increase your overall profit levels

- Never delay the decision-making process because you don’t have all the answers you need

- To always make prudent investment or debt decisions

Other articles

DEVELOPING THE BEST FINANCIAL STRUCTURE

Get it sooner and you can invest it faster. The decision-making process is always easier if the top leadership is able to review swiftly the financial information of the company. For example, it should be unacceptable to wait weeks just to receive reports about the...

COMPENSATION ANALYSIS EXPLAINED

IMPORTANCE

The Compensation Analysis examines the financial burden and contribution of employees in an organization. Many decision makers tend to ignore the compensation analysis and it is to their detriment for long-term success.

PERFORMANCE MANAGEMENT EXPLAINED

IMPORTANCE

Performance Management measures the efficiency of the business and financial systems of a company. It also serves to enlighten possible areas of concern that may be detrimental to the organization’s smooth operation and financial profitability.

WHAT IS BUSINESS INTELLIGENCE (BI), AND HOW HELPFUL IS IT?

We live in a new Era We live in an era where speed and efficiency are the most desirable characteristics. The ability to obtain data, manipulate it, and develop actionable steps based on the information collected determines the secret to achieving these two factors....

GROWTH MANAGEMENT EXPLAINED

IMPORTANCE

Growth Management is the process in place to ensure that the company’s market value increases on a consistent basis.

The following key tenets will ensure growth on a long-term basis:

FINANCIAL ANALYSIS EXPLAINED

IMPORTANCE

The financial analysis enables the decision-maker to review the financial information of the company and make the best decisions. It should be unacceptable to manage any operation or project without fully understanding your financial position.