Having a rock solid strategy is easier than you think.

Insight:

There are multiple pricing structures and strategies available to implement. For instance, a smaller company with hopes of integrating a larger market may engage in price penetration strategies. With this approach, a low introductory pricing tactic may be best to lure in new customers. Alternatively, a more well-known company may use the differentiation pricing strategy. In this case, the strength of its brand may warrant a premium pricing strategy without fears of losing the already acquired market share to the less established companies.

Nevertheless, the majority of organizations use Cost-Plus Pricing, which simply adds a mark-up on top of the cost of production/servicing. The goal of this simple pricing strategy is to earn a profit from operating a business. The only problem with a Cost-Plus Pricing strategy lies in the realm of long-term feasibility. For example, earning a 1% in profits may accomplish the general expected goal but may not result in long-term sustainability. In other words, wealth accumulation will not become reality.

Solution:

We will propose the concept of “Minimum Acceptable Profit (MAP)” regardless of the pricing strategy. The MAP is the established and exact threshold of profitability a company must attain to warrant its existence. In terms of operating a successful business, it should be unacceptable to engage in any pricing method that does not provide a MAP. If for example the expected MAP is 20% of sales, then the pricing structure must reflect this objective. Here the strategy is to use the MAP as cost center. Just like paying for the mortgage/lease or the electric bill, the company will classify this MAP as the most important cost above anything else. This MAP should be the first cost a company must pay above anything else. The approach is the only route that will guarantee constant profitability.

Example:

Let’s assume that a Company’s Minimum Acceptable Profit (MAP) is 20% of Sales.

Here is the simple Solution:

| Sales | $1,000,000 |

| COGS | $300,000 |

| Gross Margin | $700,000 |

| Variable Costs | $150,000 |

| Fixed Costs | $200,000 |

| Earnings Before Tax | $350,000 |

| Tax (30%) | $105,000 |

| MAP (20% Of Sales) | $200,000 |

| Net Profit | $45,000 |

Debrief:

As you can tell, the MAP is structured as a cost to be paid out to the company itself. With this model, the Company’s Net Profit becomes essentially the bonus because it is what’s left after the MAP has been secured. The leaders in the most successful organizations will place this entire MAP into the company’s “Wealth Box” (Savings Accounts). This gives them the assurance that they can withstand future contingencies.

They may use the Net Profit to give out annual bonuses to employees, invest in Research & Development or whatever else they want.

Big Question:

What happens if after paying for the MAP, there isn’t enough left to cover the rest of the costs?

Answer:

The Company needs to change its overall business model because failing consistently to secure the MAP leaves it vulnerable to future uncertainties. If a company must lower its established MAP standard to pay for other costs, then its chances of long-term survival will be slim. Just paying bills and managing to stay above water is a losing strategy to begin with.

Insight:

Again, the lack of accumulated wealth is one of the main reasons why the majority of new businesses fail within 5 years of operation. These businesses can never build enough prosperity to sustain economic downturns and market shifts.

The ultimate benchmark is to always the MAP for any effective pricing strategy. Once the MAP is reached, then any other pricing strategies may be acceptable as market situations evolve.

Other articles

DEVELOPING THE BEST FINANCIAL STRUCTURE

Get it sooner and you can invest it faster. The decision-making process is always easier if the top leadership is able to review swiftly the financial information of the company. For example, it should be unacceptable to wait weeks just to receive reports about the...

COMPENSATION ANALYSIS EXPLAINED

IMPORTANCE

The Compensation Analysis examines the financial burden and contribution of employees in an organization. Many decision makers tend to ignore the compensation analysis and it is to their detriment for long-term success.

PERFORMANCE MANAGEMENT EXPLAINED

IMPORTANCE

Performance Management measures the efficiency of the business and financial systems of a company. It also serves to enlighten possible areas of concern that may be detrimental to the organization’s smooth operation and financial profitability.

WHAT IS BUSINESS INTELLIGENCE (BI), AND HOW HELPFUL IS IT?

We live in a new Era We live in an era where speed and efficiency are the most desirable characteristics. The ability to obtain data, manipulate it, and develop actionable steps based on the information collected determines the secret to achieving these two factors....

GROWTH MANAGEMENT EXPLAINED

IMPORTANCE

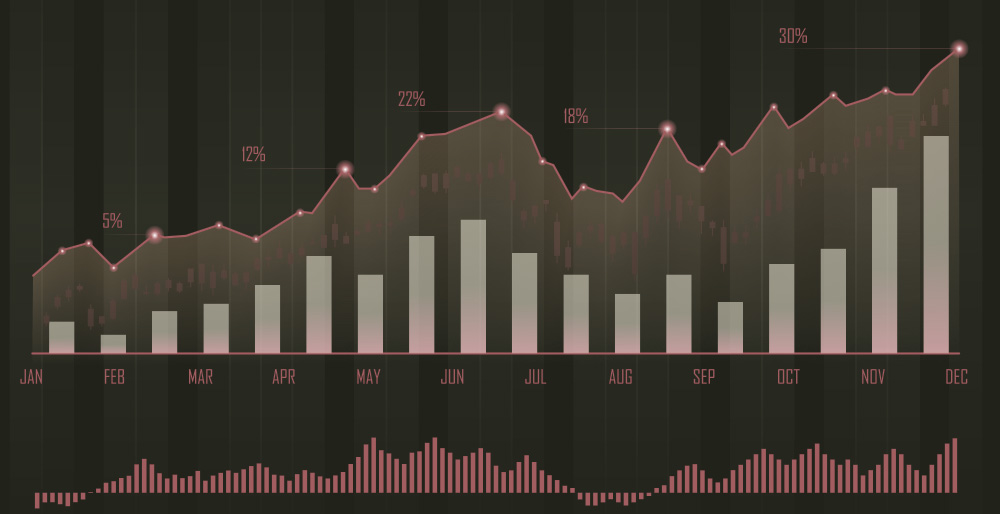

Growth Management is the process in place to ensure that the company’s market value increases on a consistent basis.

The following key tenets will ensure growth on a long-term basis:

FINANCIAL ANALYSIS EXPLAINED

IMPORTANCE

The financial analysis enables the decision-maker to review the financial information of the company and make the best decisions. It should be unacceptable to manage any operation or project without fully understanding your financial position.