With smart break-downs, everyone’s job is easier.

Insight:

Many organizations struggle to gather and process their financial information because they utilize only one system to process every transaction.

The following flawed system represents for example, the usual process utilized by the accounting department in many organizations:

Now, The Accounting Department must repeat each of the four processes for each department. Without doubt, this is an inefficient and time-consuming process that leads to frustration, endless repetitions, and errors.

Solution:

The first three processes could be easily avoided by simply requiring each department to be in charge of their own transactions. They can fix/update financial transactions that apply specifically to their department much more easily and rapidly than a central accounting department.

The proposed strategy here is to create an assembly line of processing information through each department leading to one comprehensive package. In terms of management efficiency, it establishes accountability because each department’s manager will be responsible for converting their unique data into a comprehensive report to submit to the central unit.

Insight:

Business books and theories often outline the many management systems available to implement within an organizational setting. Furthermore, these books often point out the pros/cons when using various management reporting systems without declaring the frontrunner. From a strategic standpoint, departmentalizing the reporting system by each unit is the superlative system to utilize. The other methods force confusion because they often lack basic responsibility, accountability, and systematic execution.

Other articles

DEVELOPING THE BEST FINANCIAL STRUCTURE

Get it sooner and you can invest it faster. The decision-making process is always easier if the top leadership is able to review swiftly the financial information of the company. For example, it should be unacceptable to wait weeks just to receive reports about the...

COMPENSATION ANALYSIS EXPLAINED

IMPORTANCE

The Compensation Analysis examines the financial burden and contribution of employees in an organization. Many decision makers tend to ignore the compensation analysis and it is to their detriment for long-term success.

PERFORMANCE MANAGEMENT EXPLAINED

IMPORTANCE

Performance Management measures the efficiency of the business and financial systems of a company. It also serves to enlighten possible areas of concern that may be detrimental to the organization’s smooth operation and financial profitability.

WHAT IS BUSINESS INTELLIGENCE (BI), AND HOW HELPFUL IS IT?

We live in a new Era We live in an era where speed and efficiency are the most desirable characteristics. The ability to obtain data, manipulate it, and develop actionable steps based on the information collected determines the secret to achieving these two factors....

GROWTH MANAGEMENT EXPLAINED

IMPORTANCE

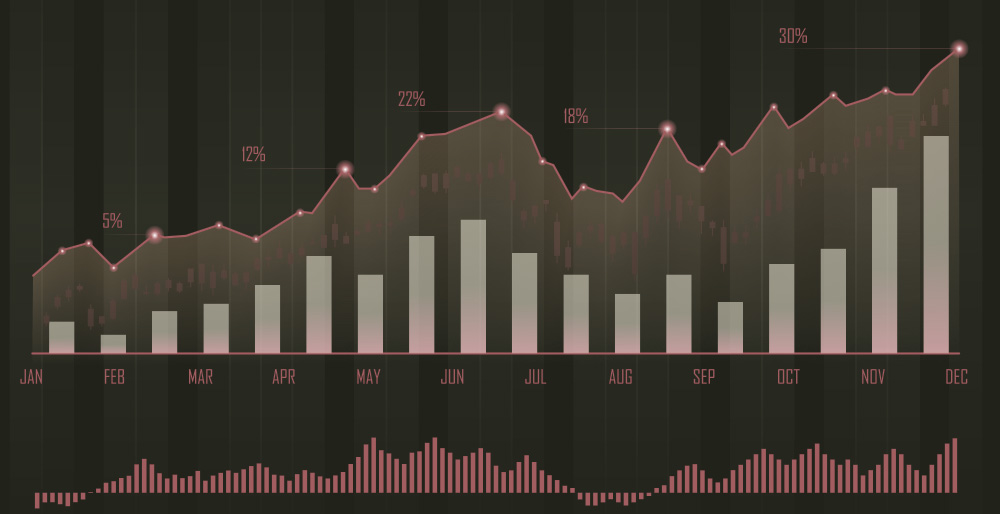

Growth Management is the process in place to ensure that the company’s market value increases on a consistent basis.

The following key tenets will ensure growth on a long-term basis:

FINANCIAL ANALYSIS EXPLAINED

IMPORTANCE

The financial analysis enables the decision-maker to review the financial information of the company and make the best decisions. It should be unacceptable to manage any operation or project without fully understanding your financial position.